Wallet Providers

Crypto Assets Self-Custody Providers are busy building gateways for mass adoption of the future of finance!

Security

Is at the core of all solutions with various compromise on flexibility, complexity, …

Seamless service adoption

Wide & straightforward access to trading venues, exchanges, DeFi investment protocols (lending, liquidity), staking, NFT, …

Increase retention

With an extensive ecosystem including services based on new features and integrations

Increase user retention by proposing an overall Digital Asset Portfolio Management, not limited to CeFi only,

but including also DeFi performance data, powered up by MERLIN

How can MERLIN help?

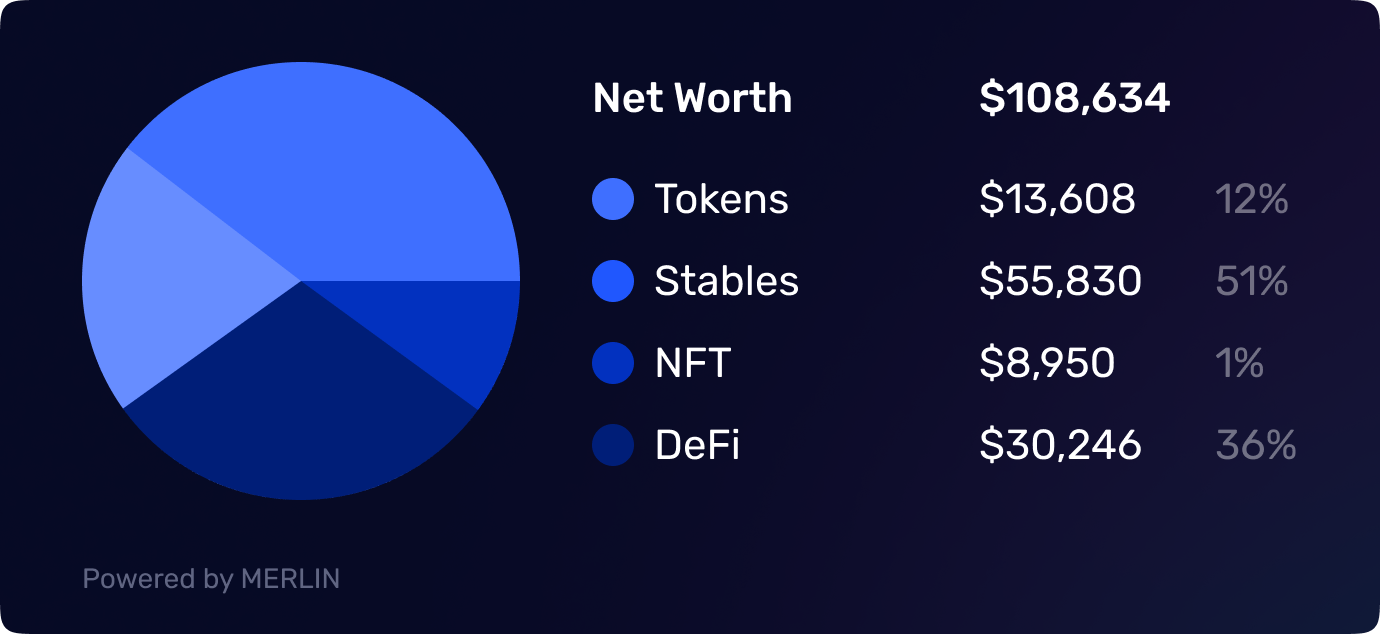

Overall Portfolio NAV, including DeFi exposures

Dedicated DeFi Dashboard: portfolio allocation & performance across Protocols

DeFi investments overview & analysis directly within your Custody solution: current and historical Positions

In-depth DeFi Position analysis: Yield, Gas Fees, Rewards, Impermanent Loss, Entry Price and overall P&L

Portfolio overview enriched with DeFi exposures

You can now track users’ holdings currently invested in DeFi!

DeFi conservatives or DeFi addicts? MERLIN provides the most extensive DeFi protocols coverage 1,500+, across 25+ chains: not limited to EVM chains, supporting also Solana, major Cosmos chains and others

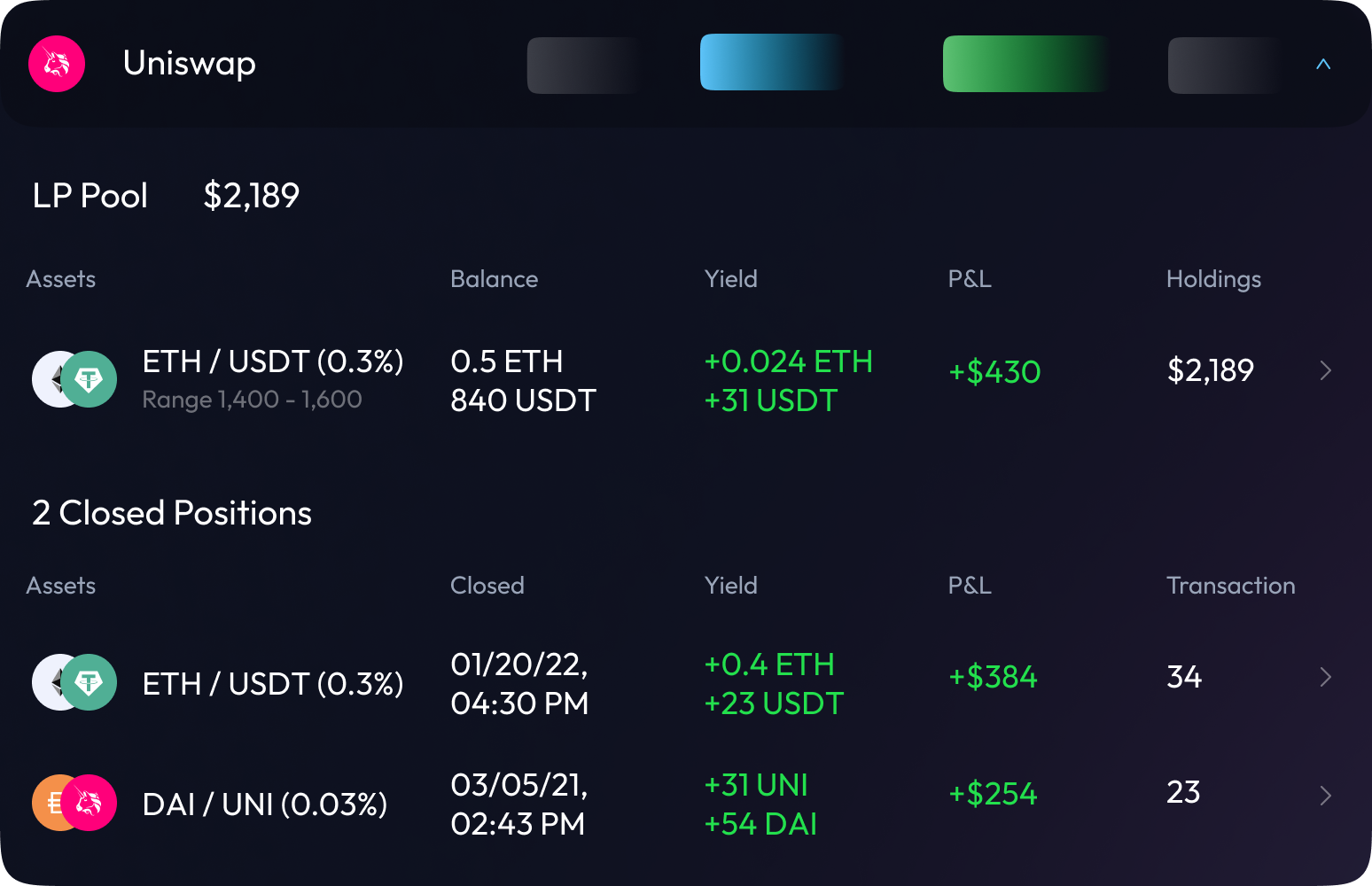

Dedicated DeFi dashboard

For users to track the allocation & performance of their funds across the different DeFi investment protocols

MERLIN won’t miss any movement, proxy wallet are supported.

No need to integrate with each DeFi protocol, MERLIN is your unique source of DeFi portfolio analytics!

DeFi Positions overview

Are your users DeFi enthusiasts? Is your Custody solution focused on DeFi? It would be great for users to track their individual DeFi positions directly via your Custody environment, and thus maintain them within your ecosystem!

MERLIN is the only DeFi data provider delivering both currently active (open) investments info – for live monitoring purpose, but also historical past (closed) investments info – for analysis purpose

DeFi investments performance analysis

Go all the way in terms of DeFi tracking by proposing P&L statistics for major DeFi investment strategies

Based on actual on-chain data (indexation), MERLIN takes no guess when it comes to Yield, Gas fees, Rewards, Impermanent Loss, Entry Price (vs actual Price fluctuation) to produce an accurate P&L; with precise USD valuation, based on protocol USD exchange rates at the precise operation execution time

How to use MERLIN?

Full integration with MERLIN API

Add DeFi portfolio performance data directly into your Portfolio Dashboards within your Custody ecosystem

All wallet balances, DeFi exposures & P&L data you can get!

Documentation available for quickstart

Backend access to track usage and top up

Pay per call, price per endpoint

Light integration MERLIN as a resource

For your community to access MERLIN web APP, their DeFi portfolio performance dashboard, directly from your resource catalog

Why MERLIN?

THE one place to get both P&L performance reporting for the major DeFi protocols and NAV for 1,500+ others, across 25+ chains

Optimize operation & maintenance by reducing the number of third party solution integrations

The best DeFi protocol coverage for active investments NAV

Focus on your business value proposition and leave the tedious on-chain data fetching & assessment to MERLIN

Leverage MERLIN’s DeFi performance data to optimize your business offer

Pay per use a powerful & straightforward API, with a freemium web APP