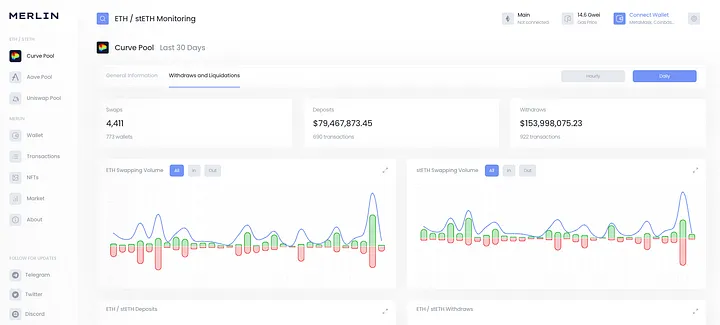

Merlin offers both protocol and pool level data analysis — tracking general and specific information related to daily/weekly/monthly volume, deposits and withdrawals, average ROI and more on protocols such as Aave, Uniswap and Curve.

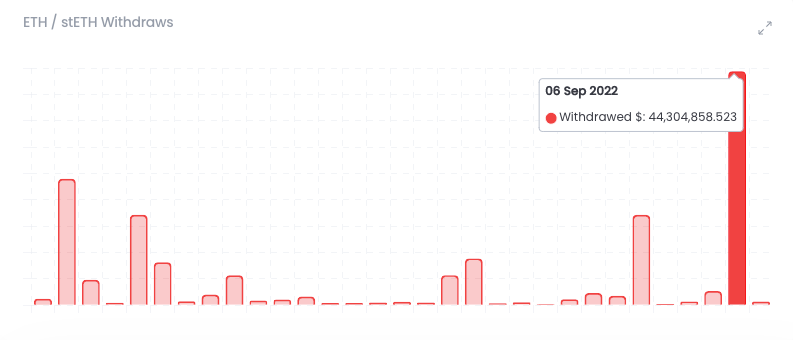

While checking recent activity on Curve, we noticed a very large spike in withdrawals from ETH/stETH. During the course of the day, over $44.3M was withdrawn, roughly double the month’s previous high and five times the average daily withdrawal.

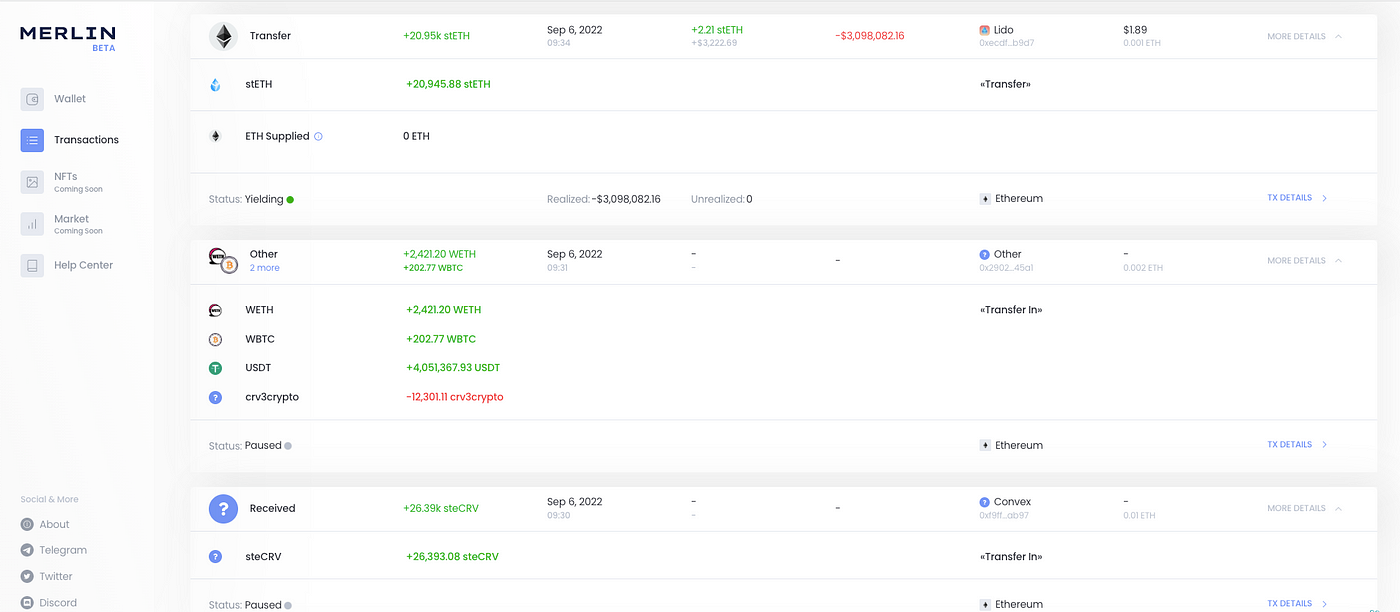

We decided to do some investigation and saw that $33M of stETH had been withdrawn by none other than a @3arrowscap wallet. https://twitter.com/0xroborosCap/status/1567090701539889152. We checked on @Nansen_ai and @Dune to confirm the wallet, and saw it was labelled as one related to the fund. @21shares provides a useful contribution on Dune tracking 3AC wallet activity: https://dune.com/21shares_research/3ac-addresses. Upon further inspection on Merlin, we saw that the 3AC wallet (0x232) was in fact one of the largest wallets on Curve by monthly trading volume, mainly as a result of yesterday’s withdrawal. The list below (3AC’s wallet is number 4) shows the highest volume trading on that Curve pool over the last 30 days

Plugging the wallet into Merlin’s search engine showed that it has since been emptied, with the assets sent to other wallets and new protocol contracts. It also pinpoints the exact time at which the withdrawal of 26.39k steCRV from the Curve pool and subsequent transfer into Lido occurred: between 9:31–9:34 AM. Merlin can spot inside a smart contract whether a transaction is linked to a swap, transfer, adding or removal of liquidity.

The timing is interesting for one reason; almost immediately after the withdrawal worth $33M occurred from Curve, there was enormous downward pressure on the stETH:ETH pair, causing the ratio of stETH:ETH to fall as low as 0.9565, the lowest since the June crash.

With the narrative for the upcoming merge, and general macro headwinds, there is a lot of volatility in the markets. Naturally, DeFi markets have been and will be spooked, and liquidity is currently very low. 100k ETH no longer seems like ‘dust’.