July 2022: how CeFi and lack of transparency created systemic risk, and why more DeFi and on-chain data would have mitigated the damage

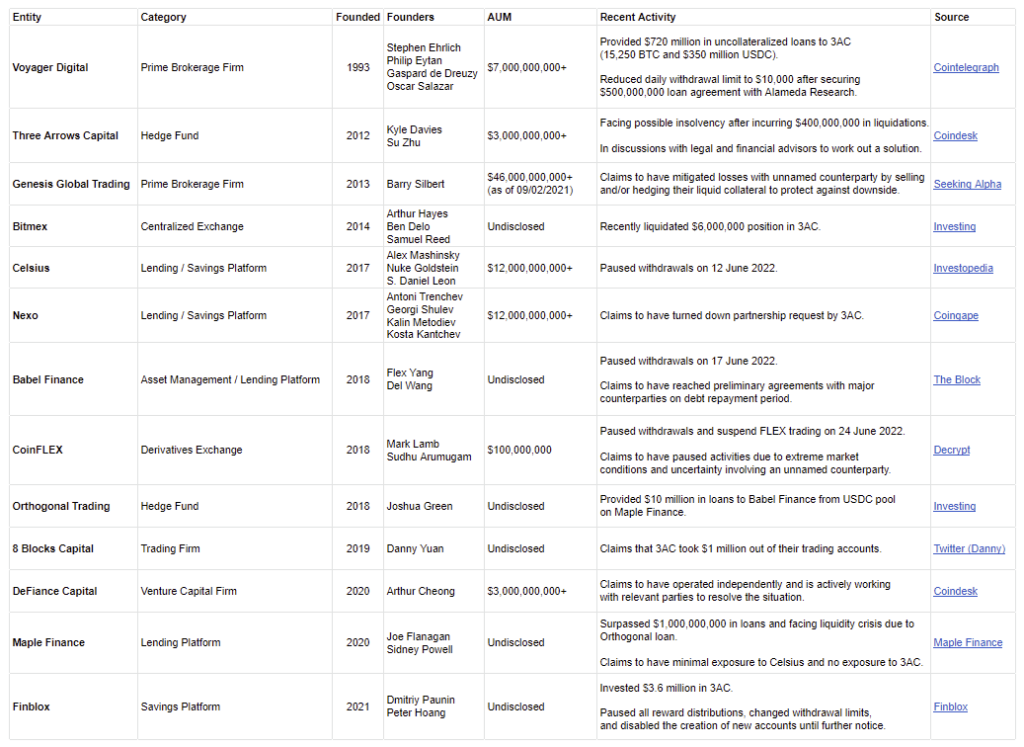

Source: https://twitter.com/ApeDigest/status/1540691313204482049

As the table above demonstrates, there have been numerous funds, lending platforms and exchanges that have been caught up in the recent market crisis.

Whether the catalyst was the LUNA/UST fiasco, deleveraging at the beginning of crypto winter or general macro headwinds, the result has been clear: contagion, with no sign of slowing just yet.

Celsius began by pausing withdrawals on June 12th, with 3AC’s insolvency concerns with over $400,000,000 in liquidations to follow. Then many lenders/investors exposed to 3AC via under/uncollateralised loans or other means of exposure to 3AC resulting in liquidity/solvency issues.

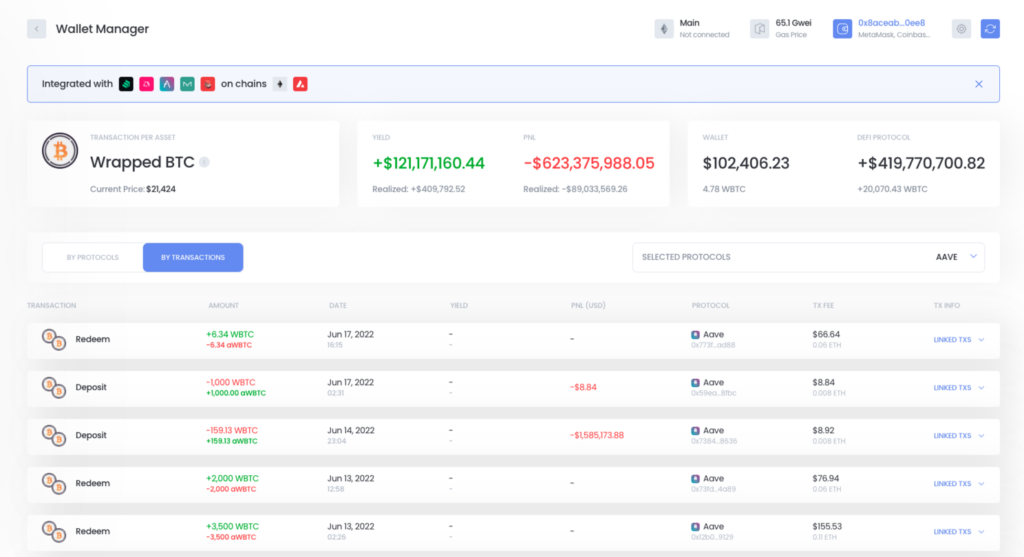

Merlin by VALK shows: Celsius’ Borrowing Position of WBTC on Aave has over $600M in the red.

Our previous thread showed the extent of some of 3AC’s losses, https://twitter.com/valktech/status/1539939565812830208 and whilst Nexo appears not to be exposed to 3AC, nor have there been any verifiable indications of an implosion

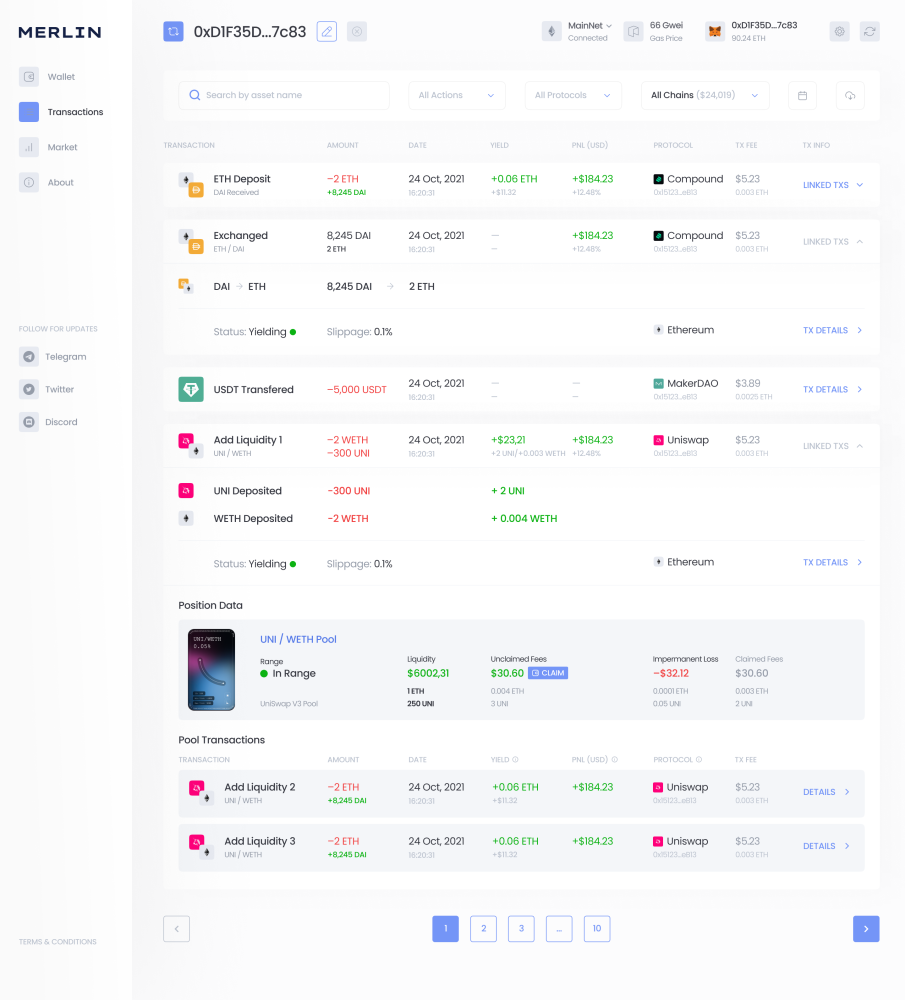

However, Nexo did have large holdings of stETH (of up to 2% of the total supply – source: Nansen https://twitter.com/ASvanevik/status/1541652533692624897), confirmed also by Merlin’s analytics of their actions on Lido:

Merlin by VALK shows: Celsius’ Borrowing Position of WBTC on Aave has over $600M in the red

One thing that was was in common for most of these entities was that their lending/borrowing was often done off-chain, behind closed doors and with adequate collateral. None of these are features of true DeFi.

Loans made on protocols such as Aave, Compound or Maker is transparent and on-chain, for the whole world to see, and is over-collateralised.

As outlined (https://twitter.com/Crypto_Texan/status/1541182202519633920), DeFi uses public blockchains and smart contracts, so finance is “open, transparent [and] composable”

If these procedures were indeed followed by entities such as 3AC, it would be clear early on which loans could be adequately serviced, and whether there was enough liquidity and solvency for them to be safely made. The contagion would probably be much less severe.

Who is to blame? The early issues of LUNA should have alerted institutional investors, yet an alarming number were overly exposed. However, unsecured lending, even in a bull market, is dangerous and apparently most of the entities were lending to 3AC without enough due diligence.

Past performance is not indicative of future results, yet a lot of blind faith was put into 3AC’s ability to repay. As is said in crypto, ever since Bitcoin’s inception: don’t trust, verify. DeFi allows verification over trust, CeFi doesn’t.

What’s next? The dust does not appear to have settled yet. More and more major players will likely report exposure to LUNA/UST, Celsius, 3AC and others. Just yesterday did Voyager Digital issue a notice of default to 3AC. https://twitter.com/DefiantNews/status/1541411286512291840

Merlin’s data analytics engine doesn’t just track aggregate DeFi transactional activity, but provides institutional-grade wallet reporting for individual portfolios, including net worth, PNL and total fee calculations.

Test out MERLIN!